Disclaimer: This blog article was written by an AdvancedMD partner. The views and opinions expressed in this article are those of the author(s) and do not necessarily reflect the official policy or position of AdvancedMD.

Are you struggling to reconcile your financial data between AdvancedMD and QuickBooks? You are not alone! Many professionals face the same challenge when managing accounts receivable and ensuring accurate financial reporting.

This guide offers a straightforward method to simplify the process without complex journal entries. By following these steps, you’ll achieve better reporting, simplify deposit and payment reconciliations, and have more time to focus on your business.

To take the edge off this daunting task, below you will find a list of step-by-step instructions to import reports from AdvancedMD to QuickBooks.

Let’s Get Started:

Step 1 – Gather Your Data from AdvancedMD Reports

- To Start, make sure the “End of Day” Routine has been run in AdvancedMD.

- Then, pull these two reports from AdvancedMD:

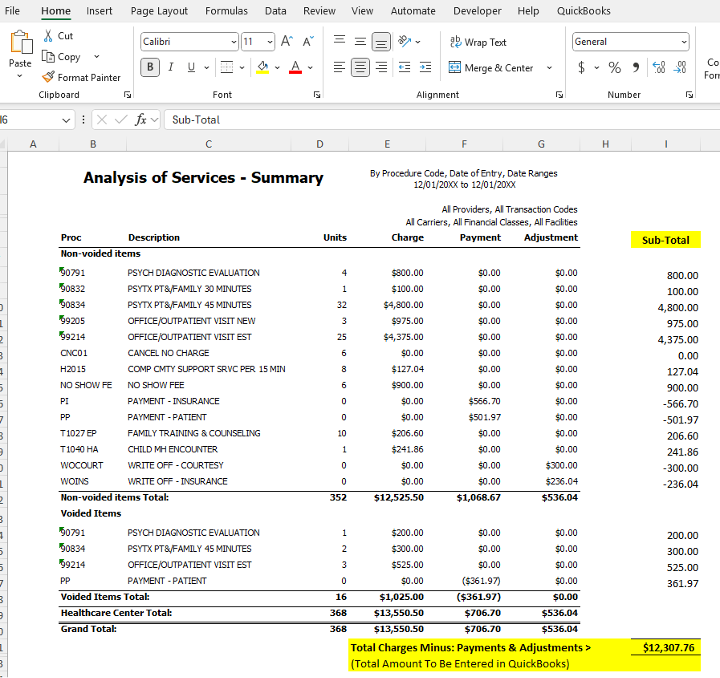

- Go to “Reports” then “Financial Totals” then “Analysis of Services Summary.”

- Set Parameters to:

- Group By: Procedure

- Date Type: Date of Entry

- Date Range: Prior Day

- Export the Report to Excel

- Create a Sub-total Column, to Sub-Total Each Row and Sub-Total the Prior Day’s Activity

- Refer to Exhibit A – for an example of a completed report.

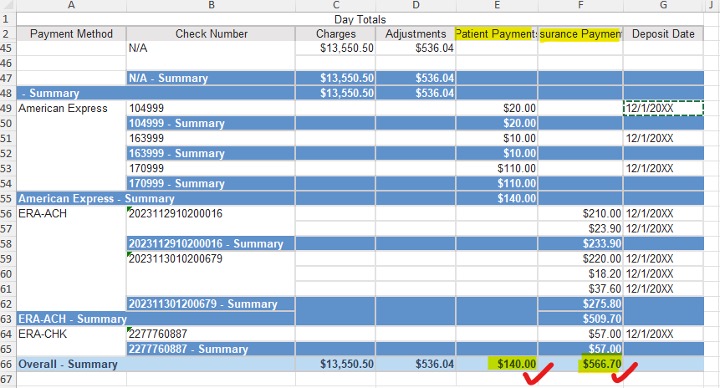

- Build a Custom Payments Report in AdvancedMD showing the “Total Deposits by Day.”

- Group Payments by: Payment Method

- Sub-Total Payments by: ACH/Check and/or Voucher Number

- Export the Report to Excel

- Refer to Exhibit B – for an example of a completed report.

*** AdvancedMD’s support team can assist you with building the custom report, subject to an additional fee. (The standard “Deposit Summary” Report provided by AdvancedMD is insufficient for this exercise.)

Step 2 – Add “Accounts” and “Product/Service” Codes in your QuickBooks Set-up

This step is a one-time set-up. However, when your billing team adds new CPT and/or write-off codes in AdvancedMD, you will need to add the new CPT and write-off codes to QuickBooks.

First – Identify and add the income and write-off accounts you want to use, for tracking and summarizing your revenues and charges for your Profit & Loss Report. In QuickBooks, go to the “Chart of Accounts” and add the relative income and write-offs accounts. Some examples might be:

- Medication Management Revenue

- Therapy Revenue

- Evaluation Revenue

- Write-Offs – Insurance & Contractual Adjustments

- Write-Offs – Small Balances, Discounts, Other

Second – Add your CPT Service Codes and Write-Off Codes to QuickBooks.

In QuickBooks, go to your “Products and Services” list and add each procedure code, write-off code, and payment code, as shown on your AdvancedMD Analysis of Services Report.

When adding your “Service” codes, use the appropriate:

- “Income Account” for Procedure Code Revenue (to track types of revenue)

- “Income Account” for Write-Off Code Revenue (to track and post negative adjustments to income)

- “Bank Account” for Credit Card Payments (to post to your bank account)

- “Undeposited Funds Account” for Patient Payments & Insurance Payments (for deposit reconciliation)

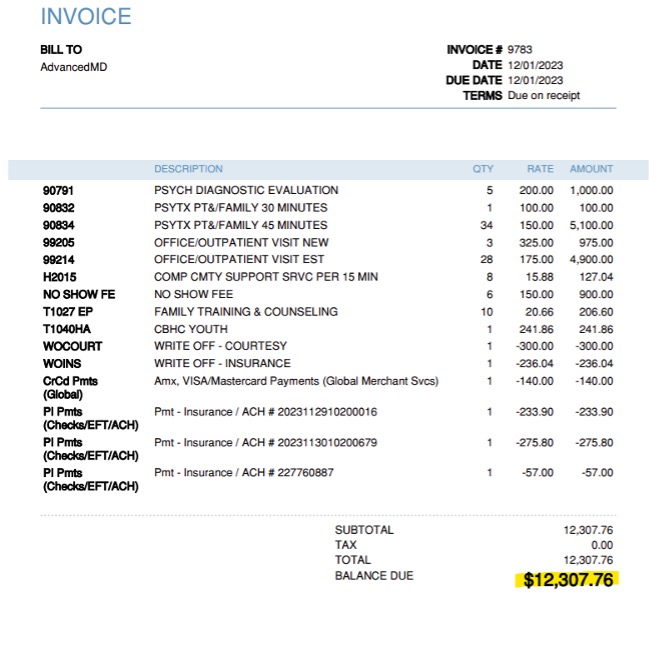

Step 3 – Finally, Enter Your AdvancedMD Report Data into QuickBooks

- Now, review the “Analysis of Services Summary” Total. If the total amount is “Negative” (decrease to Accounts Receivable) you will create a Credit Memo in QuickBooks -or- If the total amount is “Positive” (increase to Accounts Receivable) you will create an Invoice in QuickBooks.

- Login to QuickBooks and go to “Create Invoice” or “Create Credit Memo” (whichever is applicable) and enter:

- Add a New Customer Name Called: AdvancedMD

- List line-by-line, the procedure details found on the Analysis of Services Summary

- Refer to Exhibit C – for an example of a completed invoice transaction

Exhibit A – Sample “Analysis of Services Summary” report (Charges & write-off’s from AdvancedMD)

In this example, Accounts Receivable increased on 12/1/XX by the amount of $12,307.76:

- $13,550.50/total patient charges

- -$536.04/total patient write-off’s

- -$706.70/total patient & insurance payments

Exhibit B – Sample “Total Deposits by Day” (Payments entered – per AdvancedMD custom report)

In this example, Accounts Receivable Payments on 12/1/XX total to amount of $706.70:

- $140.00/patient payments (including three American Express payments)

- $566.70/insurance payments (including three ACH/ERA payments)

Exhibit C – Sample “QuickBooks Invoice” – Summarizing daily update from AdvancedMD analysis

In this example, note that Accounts Receivable (in QuickBooks) is increased by: $12,307.76:

- $13,550.50/total patient charges

- -$536.04/total patient write-off’s

- -$706.70/total patient & insurance payments

***Notice that payments are itemized by check number, found on the report from Exhibit B (for bank deposit reconciliation purposes)

I hope you find this instructional guide helpful. It saved a ton of reconciliation hours me. If you have a different or better way to accomplish this, please share it.